College Planning with Planwise

/My oldest son is going to college next year and is considering getting an apartment. I don’t know about you, but when I hear these words (“college” and “apartment”), lists of various expenses quickly start scrolling through my mind. I wanted to help my son develop a similar mental picture of this new, expensive world he is walking into. But what’s the best way to relay the enormity and variety of the expenses of this new world to my son?

In the past, my normal “go-to-tool” for adult-world planning like this has always been Excel. However, a FamilyMint partner recently introduced me to a new online planning tool targeting Gen Y called Planwise. For the task at hand, it seemed a perfect fit, and way more fun and interactive than YAES (Yet Another Excel Spreadsheet!).

Here’s an overview of how it works:

This is how I used it with my son and why I think it’s a cool tool for young adults.

First we entered what he had saved up for college (this is just an example… not his actual numbers):

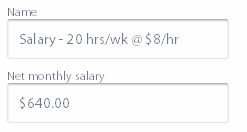

Then we added what we expected him to make in his part time job while going to college:

After we added his salary, the chart updated to show the increases in his net worth each month. Nice chart!

Of course, we hadn’t entered any expenses yet. This is where “reality” started to settle in. Each time we added an expense, the chart updated to show the impact on his monthly bank balance. This is the coolest part!

When we were done entering expenses, the line on the chart had a negative slope. With his current plan, he was going to lose money each month.

This led to an interesting discussion and a good teachable moment about ways he could reduce his expenses and/or increase his income. He got EXACTLY what I had hoped he would get out of it… visibility into his situation and the ability to plan ahead as a result.

FamilyMint is a wonderful training tool for kids, but as they get older and the world of money management becomes even more complex, no one tool can do it all. Older teens and younger adults will need additional tools to add to their financial capability tool belt. Planwise worked out perfectly to give my son a quick mental grasp of all the new expenses he was going to be responsible for at college, and let him consider ways to reduce those expenses before they occurred, not after he was already in a black hole of debt.